The Decay Model: A Stark Wake-Up Call for Gartner, Capgemini, Accenture, and McKinsey

Legacy consulting giants face a structural reckoning as old models crumble amid client caution, technological disruption, and market skepticism

Paperware Model is Crumbling

The consulting and advisory business is at a perilous inflection point in 2025. Four leading firms—Gartner, Capgemini, Accenture, and McKinsey—stand as emblematic of deep structural cracks threatening decades of established dominance. Beneath the steady surface of earnings calls and market data lies a harsh narrative: the “Decay Model,” a framework revealing how entrenched business models are eroding under new economic realities, buyer behaviors, and relentless technological change.

The Core Crisis in Five Failure Modes

Demand Erosion & Buyer Risk Aversion: Companies are slashing discretionary spend and stretching approval cycles. Gartner’s recent 28% stock plunge after cutting guidance underscores how fragile subscription and advisory models become when CFOs tighten budgets. Client buying decisions have shifted upward, bypassing traditional IT sponsors and prolonging sales cycles.

Legacy Product and Licensing Model Mismatch: The old guard of long-cycle consulting projects and research subscriptions is buckling. Modular cloud services and AI-driven tools offer faster, cheaper alternatives. Capgemini’s revenue stagnation and Accenture’s cautious transition highlight how difficult it is to pivot before the old model crumbles.

Organizational Inertia & Thick Management Layers: Culture and structure weigh heavily. The Economist’s critique of McKinsey points to bureaucratic sluggishness that undermines agility and innovation—essential in a world where speed and nimbleness are competitive advantages.

Financial Engineering & Guidance Mismatches: Over-optimistic forecasts and reliance on non-GAAP measures merely postpone reckoning. When revenue growth slows, markets punish swiftly. Accenture’s mixed signals on margin improvement and Gartner’s dramatic guidance cuts reveal investor wariness.

Market Narrative & Analyst Feedback Loop: The narrative itself becomes a self-fulfilling prophecy. Negative press and analyst skepticism deepen client and investor uncertainty, accelerating multiple compressions. The prevailing sentiment isn’t just a cyclical downturn but a profound structural decline.

Reality Check

Gartner: Once the gold standard of market insight, Gartner now battles declining demand and a model vulnerable to CFO-level cost scrutiny. Its stock has lost over half its value in the past year, signaling the market’s harsh verdict on its future.

Capgemini: Flat revenues and missed earnings reflect the bruising transition from labor-heavy integrator to productized, AI-enabled services provider. Restructuring and cost-cutting mask the uphill climb.

Accenture: The size and scale of Accenture provide some cushion, and the firm shows signs of mix improvement. Yet, skeptics question whether these changes are fast or deep enough to reverse skepticism around booking quality and revenue durability.

McKinsey: Without public stock, narrative drives perception. The firm must confront existential questions about culture, tech adaptation, and regulatory challenges—a failure to pivot risks making its famed prestige a relic.

The Decay Model Mapped to Firms

Stock Performance Snapshot

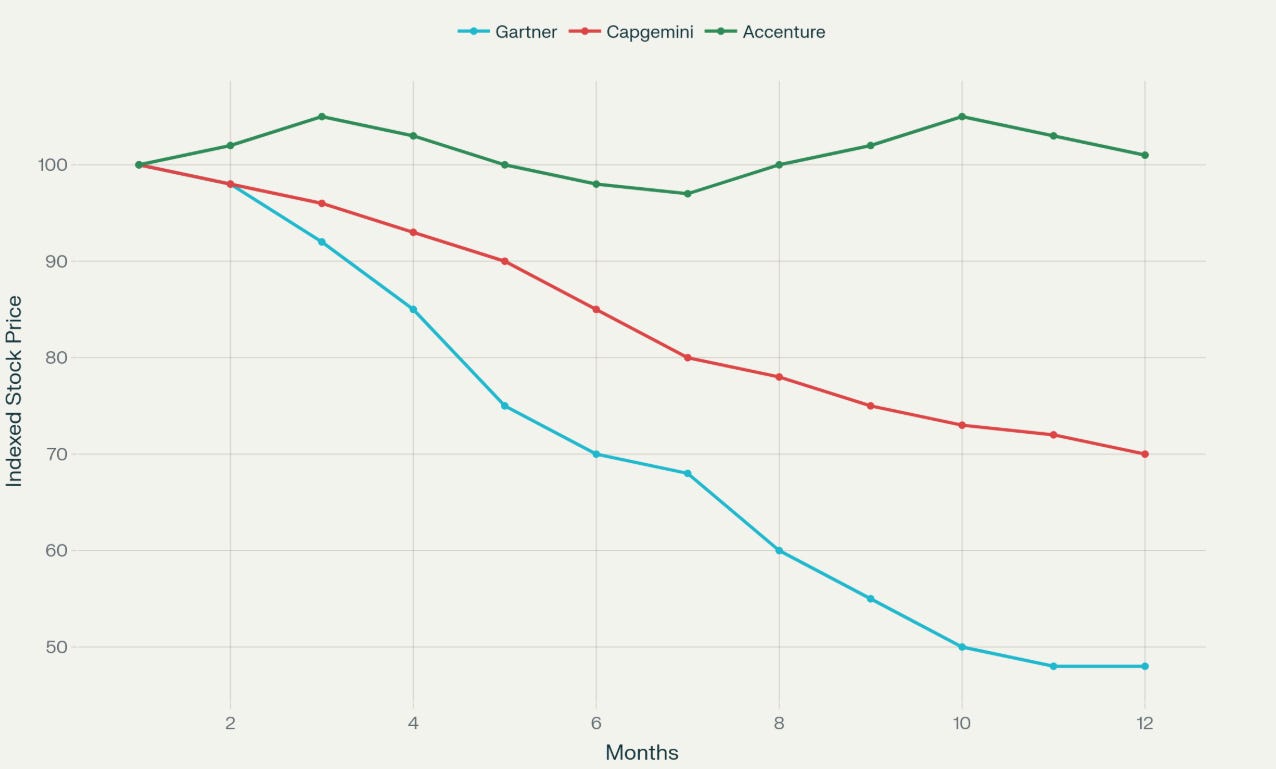

The following chart reveals stark market reactions: Gartner’s steep decline eclipses the moderate slide of Capgemini, while Accenture holds comparatively steady amid uncertainty—an investor nod to its cautious transformation path.

Indexed stock price performance of Gartner, Capgemini, and Accenture over the last 12 months, showing relative declines among these consulting firms

The Imperative: Radical Reinvention or Strategic Fade

C-suite leaders at these firms must abandon timid containment. The time for incremental cost-cutting is over. Success demands:

Outcome-Based, Productized Offerings: Move beyond selling time to selling measurable business results via SaaS, AI-enabled platforms, and subscription-based IP

Lean Management & Agile Delivery: Flatten decision hierarchies and eliminate bureaucratic drag to accelerate innovation and responsiveness

CFO-First Sales Strategies: Realign go-to-market motions to deliver clear ROI and total cost of ownership value early in the buying process

Transparent, Predictable Revenue Models: End reliance on opaque metrics. Earn investor trust with clear reporting on recurring revenue and pipeline health

Targeted M&A Focused on Scalable IP: Prioritize acquisitions that build product capabilities, not just scale headcount

Bottom Line: Old Money vs. New Market Reality

The headlines tell a story of more than a difficult quarter—they reveal a wrenching clash between legacy business models and the new realities of digital transformation, AI-driven economics, and tighter buyer scrutiny. Gartner’s collapse acts as a canary in the coal mine; Capgemini’s challenges expose integrator vulnerabilities; Accenture’s fine margins are a runway, not a guarantee; McKinsey’s cultural questions foreshadow reputational risk.

Without bold, well-executed transformation, these incumbents’ strategic relevance and market value will decline further, handing ground to more agile and innovation-focused competitors.

https://managementconsulted.com/consulting-industry-monthly-market-review-july-2025/

https://www.linkedin.com/pulse/management-consulting-landscape-2025-pzmuf

https://www.alpha-sense.com/blog/trends/consulting-industry-trends/

https://consultingquest.com/insights/future-of-consulting-trends-insights/

https://finance.yahoo.com/news/gartner-sees-29-weekly-price-053449895.html

https://www.cimdata.com/de/industry-summary-articles/item/28159-capgemini-h1-2025-results

https://strategyu.co/the-strategy-consulting-industry-firms-trends-compensation-2025/

https://finance.yahoo.com/news/why-gartner-stock-plummeted-30-234943023.html

https://www.capgemini.com/news/press-releases/h1-2025-results/

https://www.accenture.com/in-en/insights/song/accenture-life-trends

https://www.nextcontinent.net/wp-content/uploads/2025/06/2025-Business-Megatrends-Outlook.pdf